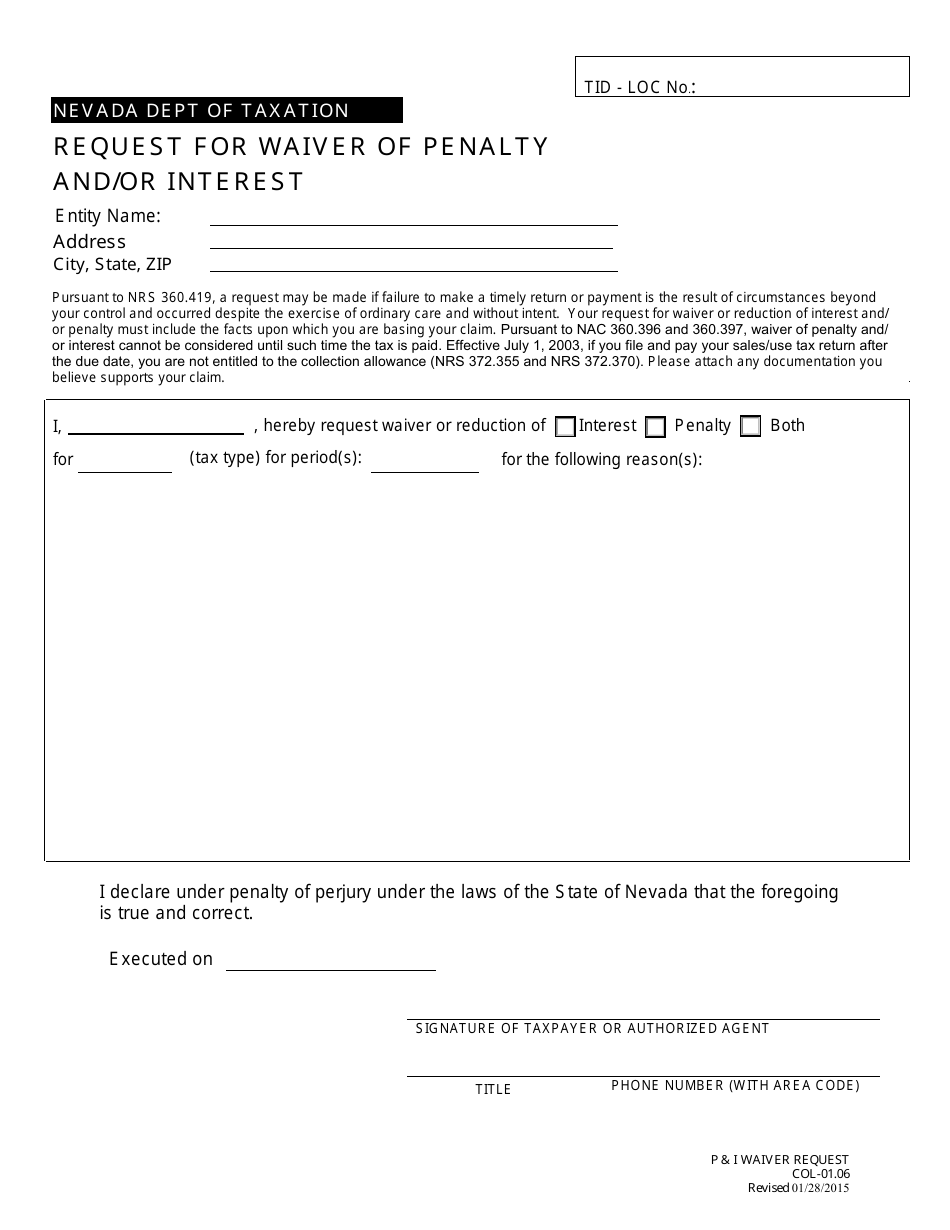

Asking For Waiver Of Penalty : Form 89 225 Download Fillable Pdf Or Fill Online Request For Waiver Of Penalty For Failure To File And Or Pay Electronically Texas Templateroller / A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you.

Asking For Waiver Of Penalty : Form 89 225 Download Fillable Pdf Or Fill Online Request For Waiver Of Penalty For Failure To File And Or Pay Electronically Texas Templateroller / A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you.. The process for asking for a penalty waiver is relatively easy. If you file electronically, there is a box to check to request a penalty waiver. Penalty waiver request, offer of compromise or protest. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. You sent a written request to the irs asking them to remove the penalty the irs denied your request to remove the penalty (penalty abatement) you received a notice of disallowance, which gives you your appeal rights for an overview of the penalty appeals process, see publication 4576, orientation to the penalty appeals process pdf.

Has no prior penalties (except a possible estimated tax penalty) for the preceding three years. A waiver letter is a formal written request for the party receiving the letter to forego a certain restriction that would otherwise be put into effect, such as a financial obligation, contract, or a citation. The irs grants waivers for specific tax penalties. Dear sir or madam, regarding checking account: The taxpayer has the burden of proving that the penalty waiver request is valid.

The letter must clearly, yet concisely state the reason for such a request.

You may also contact us to request a penalty waiver by mailing a letter or sending a secure message. You can technically either call the irs to claim for reasonable cause. To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your current circumstances and any documentation that supports your position. If you received a notice, be sure to check that the information in your notice is correct. The waiver request should state the specific reasons for failure to file the statement of information within the required filing period. If you have an irs penalty on your hands, you can get a waiver. Interest is never waived unless it was an issue that was caused by fdor. A waiver letter is a formal written request for the party receiving the letter to forego a certain restriction that would otherwise be put into effect, such as a financial obligation, contract, or a citation. Here is a sample waiver letter for waiving personal rights. The letter must clearly, yet concisely state the reason for such a request. Dear sir or madam, regarding checking account: To reach another division with the secretary of state's office, please go to the main agency contact information page. Late penalties of 19 to 29% proceed as follows taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid.

If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived. To do this, you must claim reasonable cause through an irs penalty abatement reasonable cause letter. Interest charged on a penalty will be reduced or removed when that penalty is reduced or removed. You can technically either call the irs to claim for reasonable cause. Reasonable cause may exist when you show that you used ordinary business care and prudence and.

Email penalty waivers for failing to file statement of information.

You can view this form in: The waiver request should state the specific reasons for failure to file the statement of information within the required filing period. To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your current circumstances and any documentation that supports your position. The sender should request the signed waiver be returned by certified mail. Email penalty waivers for failing to file. To reach another division with the secretary of state's office, please go to the main agency contact information page. Late penalties of 19 to 29% proceed as follows taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. The irs grants waivers for specific tax penalties. However, if you want to improve your chances of your request being accepted, you should work with a tax professional. I would like to request that you consider reimbursing bank charges you applied to an unplanned overdraft that has been building up since last year. Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. You sent a written request to the irs asking them to remove the penalty the irs denied your request to remove the penalty (penalty abatement) you received a notice of disallowance, which gives you your appeal rights for an overview of the penalty appeals process, see publication 4576, orientation to the penalty appeals process pdf. For a temporary waiver of inadmissibility.

Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your current circumstances and any documentation that supports your position. I would like to request that you consider reimbursing bank charges you applied to an unplanned overdraft that has been building up since last year. Waiver requests for late reports and payments the comptroller's taxpayer bill of rights includes the right to request a waiver of penalties. You can use our online form to request a waiver of penalties and/or interest that was assessed because you filed or paid a tax report late.

For instance, you may be given a citation, a penalty fee, or a new financial obligation.

If you have an irs penalty on your hands, you can get a waiver. Click the button below to file. Home » unlabelled » request to waive penalty : The law requires dor to assess a 9% late penalty if the tax due on a return filed by a taxpayer is not paid by the due date. Email penalty waivers for failing to file. You can view this form in: If the waiver is denied, the penalties will be billed at a future date. Name of property owner address of property owner city, state. A waiver letter is a formal written request for the party receiving the letter to forego a certain restriction that would otherwise be put into effect, such as a financial obligation, contract, or a citation. However, every taxpayer is entitled to request abatement of penalties if they have a reasonable cause for filing or paying late. I would like to request that you consider reimbursing bank charges you applied to an unplanned overdraft that has been building up since last year. We will review your request and respond in writing. Sample letter waiver of penalty for reasonable cause.

Komentar

Posting Komentar